The global Polycrystalline Silicon Market is estimated to be valued at US$ 9.64 billion in 2022 and is expected to exhibit a CAGR of 13.4% over the forecast period 2023-2030, as highlighted in a new report published by Coherent Market Insights.

Market Overview:

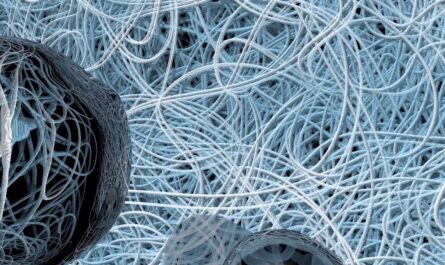

Polcrystalline silicon or multi-crystalline silicon is a material made from granular solar grade silicon and is used to manufacture photovoltaic or solar modules. It has nearly the same atomic structure and composition as single crystal silicon but contains multiple small silicon crystals or grains in the solid material. Polycrystalline silicon provides an economical alternative to single-crystal silicon for making solar cells without compromising much on conversion efficiency. It offers advantages such as simpler manufacturing process, lower material purity requirement, less energy consumption and higher productivity compared to single crystal silicon. This has propelled its use in photovoltaic industry to drive the adoption of renewable energy.

Market key trends:

One of the key trends in the market is growing demand for polycrystalline silicon from photovoltaic industry. Global installation of solar PV systems has been increasing at a rapid pace over the past few years due to supportive government policies and initiatives regarding use of renewable energy. According to International Energy Agency (IEA), worldwide solar PV capacity has increased from 98 GW in 2015 to over 600 GW in 2020 driven by China, United States, India and Europe. This rise in solar PV deployment has led to substantial growth in demand for polycrystalline silicon which is used in manufacturing majority of solar modules currently available in the market. Another trend is technological advancements to improve the efficiency and lower the cost of production of polycrystalline silicon. Key manufacturers are investing in R&D to develop better processes like fluidized bed reactor technology which can enhance energy efficiency and productivity. This is expected to make solar power more affordable and boost the adoption of solar PV systems using polycrystalline silicon in near future.

Porter’s Analysis

Threat of new entrants: The polycrystalline silicon market requires high capital investments for setting up manufacturing plants and also requires technical expertise. This acts as a barrier for new players to enter the market.

Bargaining power of buyers: The polycrystalline silicon market has a large number of buyers globally but each individual buyer has a small percentage of the total market share. This gives buyers lower bargaining power.

Bargaining power of suppliers: The suppliers of raw materials required for manufacturing polycrystalline silicon have a significant bargaining power due to the consolidated nature of supply.

Threat of new substitutes: There exist limited substitutes for polycrystalline silicon as it is an important raw material for solar PV modules and semiconductor industry.

Competitive rivalry: The polycrystalline silicon market is highly competitive with major global players competing in terms of production volume and pricing.

Key Takeaways

The global Polycrystalline Silicon market Share is expected to witness high growth, exhibiting CAGR of 13.4% over the forecast period, due to increasing demand for solar energy. China dominates the global polycrystalline silicon market currently accounting for over 50% of the global production capacity owing to presence of major manufacturers in the country and strong government support for solar energy adoption.

Regional analysis indicates that the Asia Pacific region will continue dominating the polycrystalline silicon market during the forecast period. This is attributed to rapidly growing solar PV installation in major Asian economies like China and India. Moreover, countries like South Korea, Taiwan, Malaysia and Vietnam are emerging as new manufacturing hubs for solar PV.

Key players operating in the polycrystalline silicon market include Wacker Chemie AG, OCI Company Ltd., GCL-Poly Energy Holdings Limited, Hemlock Semiconductor Corporation, Tokuyama Corporation, REC Silicon ASA, Daqo New Energy Corp., SunEdison, Inc. (acquired by MEMC Electronic Materials), LDK Solar Co., Ltd. (faced financial difficulties in the past), TBEA Co., Ltd. These companies are focusing on expanding their production capacities to cater to the rising demand from solar and semiconductor industries globally.

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it