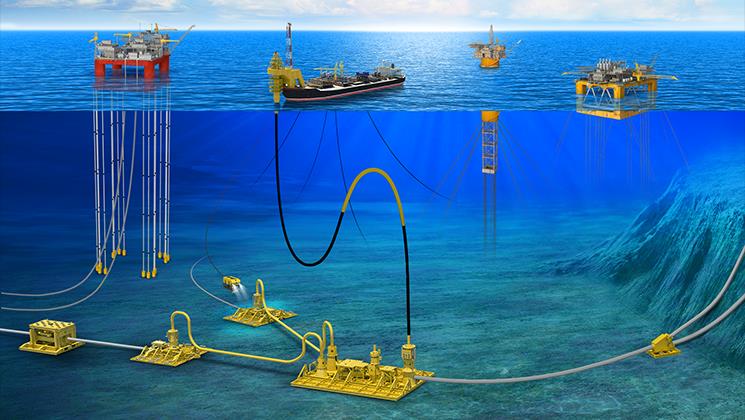

The offshore pipeline market involves the transportation of crude oil, refined petroleum products, and natural gas from offshore oil rigs and platforms to onshore facilities for further refining and distribution. Offshore pipelines reduce the need for tankers and help transport hydrocarbons in a safer, more efficient, and cost-effective manner. They play a critical role in supplying energy resources from offshore reserves and are generally corrosion resistant to withstand harsh marine environments.

The global offshore pipeline market is estimated to be valued at US$ 17.86 Bn in 2024 and is expected to exhibit a CAGR of 8.4% over the forecast period 2024 to 2030.

Key players in the offshore pipeline market include Becton, Dickinson and Company, Pfizer Inc., Novo Nordisk A/S, Gerresheimer AG, B. Braun Medical Inc., Grifols S.A, Baxter International, Inc., Fresenius Kabi AG, Mylan N.V., Bayer AG, F. Hoffmann-La Roche AG, Farmoquimica S.A., Novartis International AG, Eli Lily and Company, União Química Farmacêutica, Nacional S.A., Cristália, Aspen Pharmacare Holdings Limited, Blau Farmaceutica S.A., Halex Istar Indústria, Farmacêutica SA, Eurofarma, Ache Laboratorios Farmaceuticos SA, Laboratorio Teuto Brasileiro S/A, EMS Pharma, and Hipolabor Farmaceutica Ltda.

Key Takeaways

Key players in the offshore pipeline market

Key players operating in the offshore pipeline market include McDermott, Saipem, Subsea 7, TechnipFMC, Fugro, Atteris, Penspen, Petrofac, Senaat, and Wood Group. They have significant experience and expertise in offshore pipeline installation, inspection, repair, and maintenance services.

Growing demand for offshore hydrocarbon resources

There is a rising global demand for oil and gas coupled with depleting onshore reserves. This has led to substantial exploration and production activities moving to offshore locations. Offshore pipelines help boost hydrocarbon output from such reserves in a safer, more environment-friendly manner.

Increasing global focus on expanding LNG trade

Many countries are focusing on developing strategic pipeline networks to facilitate long-distance transportation of liquefied natural gas (LNG) via sea routes. This will help establish new global supply chains and trading partners. Considering offshore pipelines offer a cost-effective way to transport LNG over long distances, their usage is likely to increase substantially.

Market Key Trends

Connections between deepwater hydrocarbon finds and onshore facilities

New oil and gas finds are increasingly occurring in ultra-deepwater and remote offshore locations. This necessitates the development of new, long-distance pipelines to link such deepwater reserves with onshore processing and distribution infrastructure. Key projects involve construction of multi-hundred kilometer pipelines in difficult terrains.

Digitization and use of remote technologies

To optimize operations and maintenance of Offshore Pipeline Market Demand spanning thousands of kilometers, industry players are investing in digitization. This involves deployment of technologies like sensors, IoT, AI, and digital twins to remotely monitor pipeline integrity, detect faults, predict failures and automate repairs. This helps improve safety, reduce downtime and lower project costs over the long run.

Adoption of innovative materials

With pipelines now being installed in harder-to-access deepwater geographies and ultra-harsh environments like the Arctic, advanced corrosion resistant materials like high manganese steel, super austenitic stainless steel and polymers are gaining popularity. Their superior strength and durability helps sustainably transport hydrocarbons from difficult reservoirs.

Porter’s Analysis

Threat of new entrants: High capital requirements for offshore pipeline projects act as a barrier for new entrants.

Bargaining power of buyers: Oil and gas companies have significant bargaining power over pipeline operators due to lack of alternatives for transportation.

Bargaining power of suppliers: Pipeline operators have limited supplier options and are dependent on equipment and services providers.

Threat of new substitutes: Alternate modes of transportation like tankers pose minimal threat currently.

Competitive rivalry: Intense competition exists among major pipeline operators to expand networks and cater growing demand.

Geographical Regions

The offshore pipeline market in Europe accounts for around 30% of the global market value, led by extensive pipeline networks in the North Sea linking oilfields to major ports in the U.K. and Norway. The Asia Pacific region is projected to be the fastest growing market during the forecast period owing to ongoing expansion of LNG import infrastructure in China, India and Southeast Asia to meet rising energy demand. Countries like India are also focusing on building offshore pipelines for transporting domestic oil and gas production.

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it