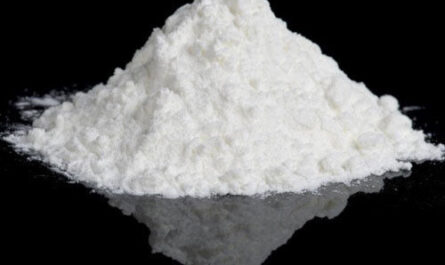

Sludge treatment chemicals help improve the handling characteristics of sludge and reduce the volume for transportation and disposal. Key functions include coagulation, flocculation, pH adjustment, odor control, and biogas production.

The Global sludge treatment chemicals market is estimated to be valued at US$ 11.34 Bn in 2024 and is expected to exhibit a CAGR of 5.9% over the forecast period 2024 to 2031.

Rapid urbanization, increasing industrialization, growing population, stringent wastewater treatment regulations are the major factors propelling the demand for sludge treatment chemicals.

Key Takeaways

Key players operating in the sludge treatment chemicals are BASF SE, Chembond Chemicals Limited, GE Water and Process Technologies, Kurita Water Industries Ltd., Ion Exchange, Kemira Oyj, AkzoNobel N.V., Solenis, Thermax Ltd., and Veolia Water Technologies. Key players are focusing on developing innovative solutions to reduce sludge levels and minimize the volume of sludge disposed of in landfills.

The rapidly growing population and urbanization are expected to drive the demand for efficient wastewater management. Growing environmental concerns regarding untreated sludge disposal are also propelling the need for sludge treatment.

Stringent wastewater discharge norms in countries across the globe are pushing industrial facilities and municipal corporations to invest in advanced sludge treatment processes, thereby creating growth opportunities for Sludge Treatment Chemicals Market Size players globally.

Market Key Trends

Rising installation of decentralized and compact wastewater treatment systems is expected to open lucrative growth opportunities for specialized sludge treatment chemicals manufacturers. Compact systems require chemicals having properties like low dosing and instant action, leading to their increased uptake. Growing focus on recovering resources like energy, nutrients and water from sludge processing is expected to drive innovations in sludge treatment chemicals formulations.

Porter’s Analysis

Threat of new entrants: Sludge treatment chemicals require high capital investments and established distribution channels, limiting threats from new entrants.

Bargaining power of buyers: Large volume buyers can negotiate better prices but the need for sludge treatment restricts their power.

Bargaining power of suppliers: The market has many global players reducing individual suppliers’ control over prices.

Threat of new substitutes: No close substitutes exist for sludge treatment chemicals in sludge dewatering and wastewater treatment applications.

Competitive rivalry: The market is dominated by few global players intensifying competition; pricing pressure exists due to similar product portfolios.

Geographical Regions

North America accounted for the largest market share in terms of value owing to stringent wastewater treatment regulations and higher adoption of sludge dewatering solutions across industries. The Asia Pacific region is expected to grow the fastest during the forecast period due to rapid urbanization and industrialization in major economies like China and India driving the need for wastewater treatment. Countries are investing heavily in upgrading existing infrastructure and expanding treatment capacities.

*Note:

1.Source: Coherent Market Insights, Public sources, Desk research

2.We have leveraged AI tools to mine information and compile it